How we Calculate Tax, Net Revenue and Gross Profit.

When creating a new item or uploading new items in a .CSV file you will be asked for a Cost Price, a Retail Price and a Tax Rate.

- The Cost Price is the net cost price and for tax and revenue calculation purposes we don't consider any tax paid in the purchase of an item.

- The Retail Price is the price that the item is sold for including tax which in the UK is VAT at 20%. This means, for example, that an item priced at £12.00 will have a price before tax is added of 12 divided by 1.2 giving a value of £10 for the item and £2 for VAT.

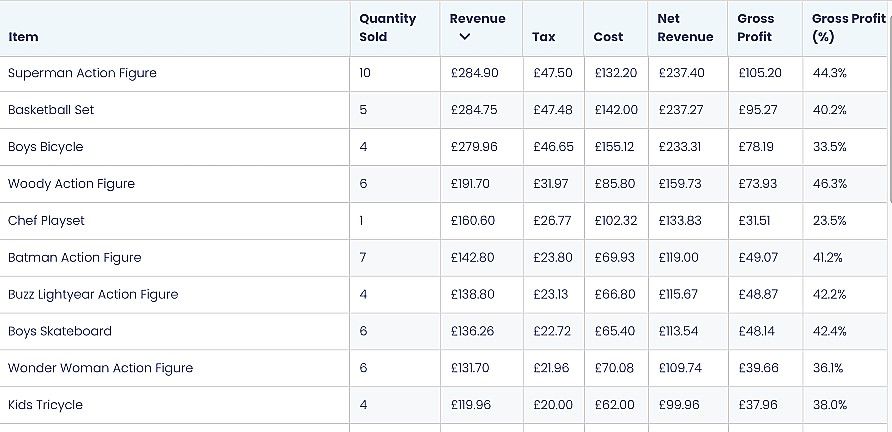

- We advise users to always assign a tax rate to each item, even if it is a rate of zero (it makes it easier to change the tax rate and apply it to your items if you become VAT registered). Below is an example of a Report which shows the different figures we calculate.

- 'Quantity Sold' is self explanatory and is the quantity of an item sold in a given daterange.

- 'Revenue' is the gross revenue and is calculated as the product of the 'Quantity Sold' and the 'Retail Price'.

- 'Cost' is the net cost of the item. It is treated as the cost excluding tax. It is calculated as the product of the cost of each product sold and the quantity of each item sold.

- 'Net Revenue' is calculated as the 'Revenue' generated minus the 'Tax'.

- Gross Profit is the Net Revenue minus Cost.

- 'Tax' is the difference between the total Revenue and the Net Revenue so Tax = Revenue - Net Revenue.

- 'Gross Profit' is Net Revenue minus Cost.

- 'Gross Profit %' is the Gross Profit expressed as a percentage of the Net Revenue.

If we take the example of the Boys Bicycle above the 'Revenue' is the retail price multiplied by the quantity sold which is

£69.99 X 4 = £279.96

The 'Net Revenue' is 'Revenue' excluding 'Tax' (which is 20% in this instance) and is therefore calculated as 'Revenue' / 1.2 = £233.3

The 'Tax' is the difference between the "Revenue' and the 'Net Revenue'. So that's 279.96 - 233.3 = 46.65

The 'Gross Profit' is the 'Net Revenue' minus the 'Cost Price' which is 233.3 - 155.12 = 78.18 (all tax calculations are rounded up).

The % Gross profit is 'Gross Profit' divided by 'Net Revenue' times 100 which is 78.18 / 233.3 = 33.5%