Setting Up and Modifying Tax Rates through the AirPOS Backoffice

Setting up tax rates is an important task and it is advisable that it be one of the first performed in setting up your AirPOS installation. It is also recommended that products not be added without a tax rate attached (even if it is only set at zero). This means that if legislation changes and items in your inventory which were not previously subject to a sales tax now are it is an easy matter to go into the backoffice and amend the tax rate accordingly, instantly updating all these products. Simply enter in the Tax Rate, name and an optional description in the fields shown to distinguish different Tax Rates.

AirPOS employs an open and flexible tax tabling system allowing you to create your own tax rates, thus enabling the system to be used in many differing locations where tax rates vary.

An example of this is United Kingdom VAT (Value Added Tax) which is applied to most items sold in the United Kingdom and at the time of writing was set at 20%.

Another example is US Sales Tax, which not only varies from state to state, but can actually be set at differing rates within States. This necessitates the need for a flexible tax system and therefore within AirPOS each product can have their own Tax Rate attached. These, however must be created prior to adding the product. The tax rate can be modified at a later date as required.

NOTE: If a 0% Tax Rate is required for products or services being sold through AirPOS this must also be created for use. The logic behind this is that while some products or services may currently have a 0% Tax Rate, this may later change in line with new legislation for example.

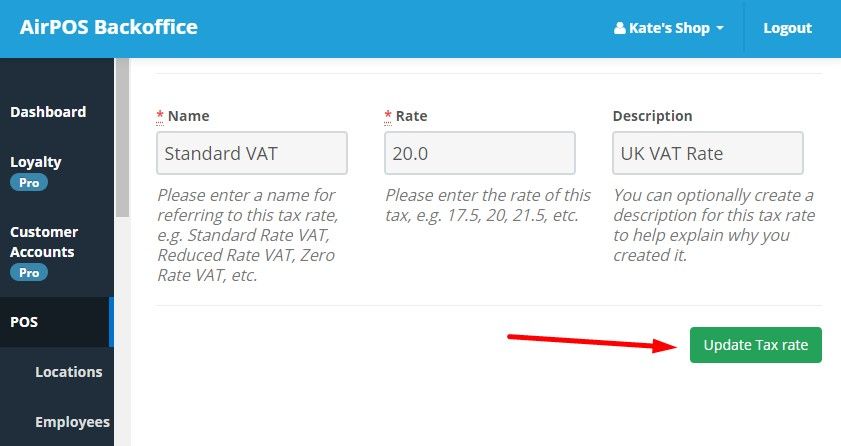

Again, AirPOS allows the flexibility to change this rate, and any rate, at any time using the ‘Modify Tax Rate’ button. AirPOS also maintains a record of the past rate that was set so as audit trails are correct and sales reporting is accurate.

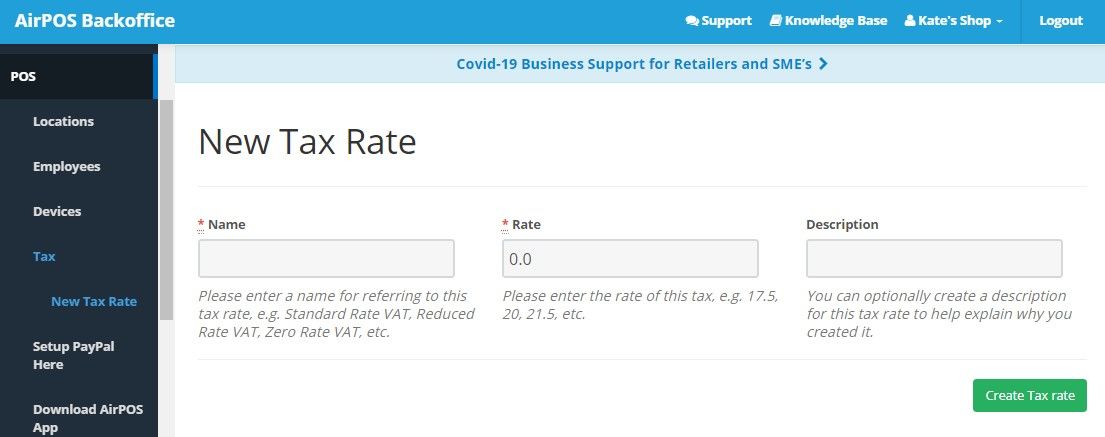

To create or modify a tax rate click on ‘POS’ in the left navigation panel of the backoffice and then ‘Tax’. To create a new tax rate press the green ‘Create New Tax Rate’ button and complete the form to give it a name, description and percentage rate then press the ‘Create Tax Rate’ button as seen here.

To modify an existing tax rate click on ‘Modify Tax Rate’ to the right of the tax rate to be changed.