From the 31st of March the temporary VAT rate of 12.5% for certain products in the hospitality sector such as 'Hot Drinks' will revert to the Standard rate of VAT 20%.

The following products and services were on the temporary reduced rate of 12.5%:

- Hospitality: supplies in the course of catering including supplies of hot and cold food and drink to be consumed on the premises and supplies of hot takeaway food and drink to be consumed off the premises

- Accommodation: the provision of hotel and holiday accommodation, pitch fees for caravan parks and tents and related facilities

- Attractions: admission to attractions not covered by the cultural exemption.

If you have setup a temporary tax rate of 12.5% for those products to which it applied then the quickest and simplest way to move all of the products back to the Standard 20% rate is to modify the existing temporary Tax Rate.

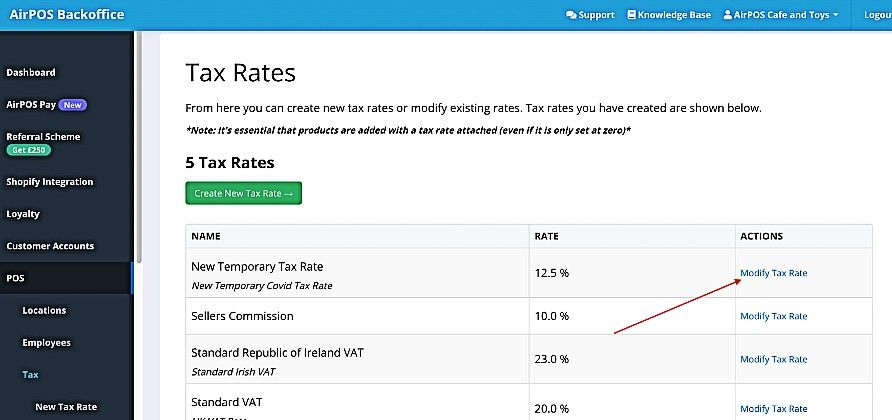

To do this go to your account backoffice and select 'POS' from the menu on the left. Select 'Tax'. All of your tax rates will be displayed. Click or tap on the 'Modify Tax Rate' link to the right of the temporary tax rate.

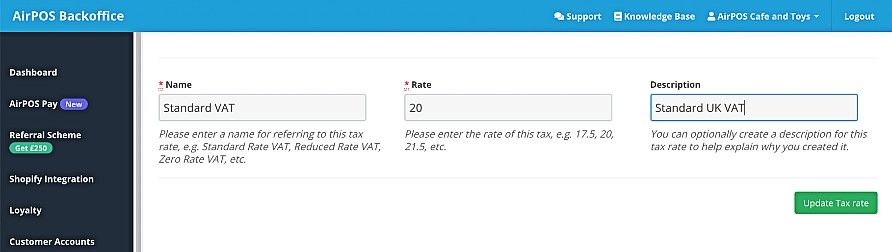

Rename the tax rate and change the rate as shown below.

Press the green 'Update Tax rate' button and all the products at the temporary rate of 12.5% will now be on the Standard rate of 20%.